- News

- City News

- mumbai News

- ‘Unlimited’ care for pet dog Tito, share for butler in Ratan Tata will

Trending

‘Unlimited’ care for pet dog Tito, share for butler in Ratan Tata will

Ratan Tata's will provisions prioritize 'unlimited' care for his German Shepherd, Tito. His vast estate worth over Rs 10,000 crore is bequeathed to family, staff, and the Ratan Tata Endowment Foundation. Assets include properties, shares in Tata Group companies, cars, and investments in startups.

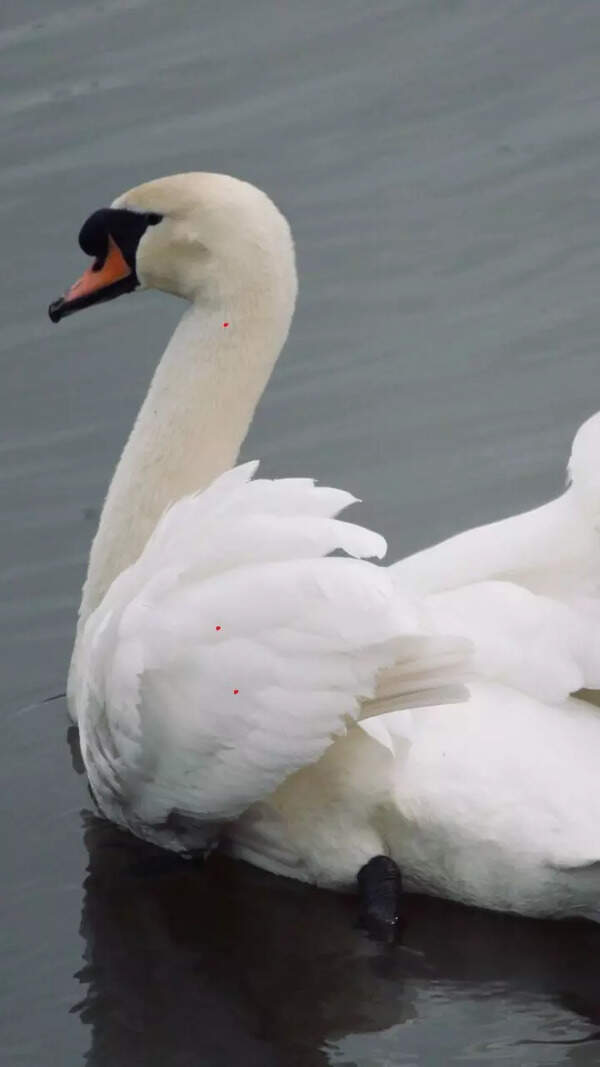

Ratan Tata with pet Tito, adopted 5-6 years ago after his earlier dog died

Ratan Tata, whose estate is estimated at over Rs 10,000 crore, also bequeathed assets to his foundation, brother Jimmy Tata, half-sisters Shireen and Deanna Jejeebhoy, house staff, and others.

Tito, adopted five or six years ago after the passing of Ratan Tata’s previous dog of the same name, will be cared for by his longtime cook, Rajan Shaw. The will also includes provisions for his butler, Subbiah, with whom Tata sh ared a three-decade relationship. Ratan Tata was known to buy designer clothes for them during his travels abroad.

His executive assistant Shantanu Naidu also figures in the will. Tata relinquished his stake in Naidu’s companionship venture, Goodfellows, and waived Naidu’s overseas education expenses.

Ratan Tata’s stake in grp cos goes to foundation

In keeping with the Tata Group’s tradition of bequeathing shares to charitable trusts, his stake will be transferred to the Ratan Tata Endowment Foundation (RTEF). Sources indicate that Tata Sons chief N Chandrasekaran is likely to chair RTEF.

The Halekai house in Colaba, where Ratan Tata lived until his passing, is owned by Ewart Investments, a 100% subsidiary of Tata Sons. Its future will be determined by Ewart. Ratan Tata designed both the Halekai house and the Alibaug bungalow, though the fate of the Alibaug property remains unclear.

The Juhu house, which also faces the beach and sits on a quarter-acre plot, was inherited by Ratan Tata and his family — brother Jimmy, half-brother Noel Tata and step-mother Simone Tata — following his father Naval Tata’s death. Sources say it has been closed for over two decades, with plans to sell the property.

In addition to Tata Sons shares, Ratan Tata’s stakes in other Tata Group companies, including Tata Motors, will also be transferred to RTEF. Established in 2022, RTEF is a section 8 company focused on promoting non-profit causes. It made its first equity invest ment by purchasing Tata Technologies shares from Tata Motors for Rs 147 crore just before its 2023 IPO and subsequently acquired a minor stake in Tata Digital, which operates the Tata Neu app.

His investments in startups through RNT Associates and RNT Advisers will be liquidated, with proceeds directed to RTEF.

Ratan Tata’s extensive collection of 20-30 cars, including luxury models, is currently housed at the Halekai residence and the Taj Wellington Mews service apartments in Colaba. The future of the collection is under consideration, with options including acquisition by the Tata Group for display in its Pune museum or auctioning.

His numerous awards and recognitions will be donated to the Tata Central Archives, ensuring that his legacy is preserved for future generations.

Despite leading the $100 billion-plus Tata Group, Ratan Tata did not appear on rich lists due to his limited personal holdings in group companies. His will is expected to be probated by the Bombay high court, a process likely to take several months.

End of Article

FOLLOW US ON SOCIAL MEDIA

Visual Stories

Hot Picks

TOP TRENDING

Explore Every Corner

US Election Results